The Concept of Globalization

Firstly, interconnections between regional respectively national economies emerge as a result of the trading of products and services across borders, and the movement of capital, workers and technological knowledge across borders. If, for example, cross-border trade or capital flows increase relative to national income, this can be described as a process of economic globalization. Secondly, globalization is often understood as market integration. A process of market integration occurs when the prices of an identical good (for example, product, labour or capital) in markets which are removed from one another geographically converge over time (price convergence) or when the development of these prices over time becomes increasingly similar. Thirdly, globalization involves the emergence of institutions which regulate cross-border economic exchange. In recent times, these have included currency and customs regimes. Fourthly, from a societal perspective, globalization refers to cross-border interaction of a political and of a social nature. This can refer, for example, to variants of colonialism and imperialism, or to participation in international organizations, or to an increasing interconnectedness at the level of civil society and the convergence of attitudes that goes with this, as well as to trends in consumption and lifestyle which increasingly transcend regional and national contexts. This article concentrates on the first three elements of globalization identified above.

An Overview of the Phases of the History of Globalization

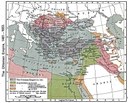

In broad terms, the history of globalization can be divided into three phases. In the first phase, which lasted until the Middle Ages, extensive long-distance trade relations which crossed cultural divides and vast empires existed on the contiguous landmass of Asia, Africa and Europe. Trading Diasporas were the main agents of these economic contacts over long distances. The transfer of goods – for example, spices from India to Europe – often involved the successive participation of several groups of traders. Thus, there was no coherent trade infrastructure. However, caravan trade within Asia was promoted in the 13th and 14th centuries by the Pax Mongolica, i. e. temporary political integration into the enormous empire of Genghis Khan (1162–1227)[

In the second phase, European global trade began when Venice was dominating the trade with the Levant in the aftermath of the War of Chioggia between Genoa and Venice (1378–1381)![Venetia 1572 IMG Frans Hogenberg (1535–1590), Venetia [Venice], in: Braun, Georg / Hogenberg, Franz / Novellanus, Simon: Beschreibung vnd Contrafactur der vornembster Stät der Welt, Köln 1582, vol. 1; digitized version, Universitätsbibliothek Heidelberg, Persistente URL: http://digi.ub.uni-heidelberg.de/diglit/braun1582bd1/0097.](./illustrationen/early-modern-ports-bilderordner/venetia-1572/@@images/image/thumb)

The third phase, which led to the present-day global economy, can be said to have begun with the rapid expansion of the European economy into the so-called Atlantic economy in the middle decades of the 19th century. This period was characterized, firstly, by the rapidly increasing importance of dietary staples and industrial raw materials in long-distance trade; secondly, by considerable international price convergence, both in relation to goods and labour; thirdly, by the intermittent free and large-scale transcontinental mobility of labour; and, fourthly, by the emergence of international capital markets.

Reasons for the Growth of Long-Distance Trade from the 16th to the 18th Centuries

From the 16th century at the latest, the volume of long-distance trade grew considerably more quickly than the European population and European economic output. From the 16th to the 18th century, the total annual tonnage of ships sailing around the Cape of Good Hope increased relatively steadily at an average rate of 1.1% per annum. In these three centuries, the population of Europe (excluding Russia) grew at an annual average rate of only 0.3%. Per capita incomes in the western European economies rose by no more than 0.2% per annum on average. From the second half of the 17th century, transatlantic trade developed considerably more quickly than European trade with Asia. For example, the number of slaves transported from Africa and sold in the Americas – who were of vital importance for the production of tropical goods exported from the Americas to Europe – increased between 1525 and 1790 by an average of 2.1% annually.3

No Reduction in Transportation Costs and Communications Costs

The period of European global trade before 1850 saw hardly any examples of price convergence, which can be attributed to the absence of a transportation revolution in the Early Modern period.4 It was only from the middle of the 19th century that European global trade expanded into a global economy, primarily due to revolutionary inventions in transportation and communications technology which drastically reduced the cost of transportation and communication (see section 5.1).

Expansion of Demand and Changes in Preferences

While per capita national income in Europe grew very slowly before the second half of the 19th century, the incomes of the elite, who bought a disproportionately large portion of traded goods, increased considerably. This was due to the growth of the state as a source of income for the elite, as well as to population growth, which made more intensive land cultivation possible, thereby increasing ground rents. The rising incomes of the elite account for a considerable portion of growth in trade between Europe and other continents before 1800. Early globalization was therefore closely connected with the long-term increase in income inequality.5

Additionally, in the late 17th and 18th centuries, tastes and preferences changed not only among the elite but among the general European population, to the extent that it is possible to speak of a Consumer and Industrious Revolution. In the late 17th century, regulations that tied individual consumption to one's estate largely disintegrated, while the consumption of luxury goods became acceptable. This increased the utility of consumption: Fashionable clothing could now be used to gain social status, and tastefully chosen domestic furniture and ornaments could accentuate one's individual identity. This brought about a shift in preferences not only towards sophisticated (better: differentiated) goods and traded goods, but also away from leisure and towards work, since the utility of goods acquired through work had grown.6

Expansion of Supply

In some cases, the fact that the prices of goods traded between continents remained stable in spite of increasing trade volumes suggested that there was scope to increase supply. Examples of this include pepper in the 16th century and tea in the 18th century. The secular inflation of silver in the modern period also suggests that the mining of silver became increasingly profitable in real terms over a long period of time. The expansion of the supply of traded goods in regions outside Europe as a result of force, organizational innovations or monetary requirements (particularly in China) made an important contribution to early globalization.7

Institutional Change

In the modern period, economic institutions in western Europe changed, which presumably reduced the transaction costs involved in the long-distance trade conducted by Europeans, thereby promoting growth in that trade.8 All the same, it is difficult to assess the importance of this process relative to the other growth factors mentioned before. However, it has been convincingly argued in relation to the United East India Company of the Netherlands, which was able to bring a majority of trade between Asia and western Europe under its control

The Phases of the History of Globalization from the Mid-19th Century

In the second quarter of the 19th century, growth in the international exchange of goods accelerated. The global economy grew in the 19th and 20th centuries by an average of nearly 4% per annum, which is roughly twice as high as growth in the national incomes of the developed economies since the late 19th century (ca. 1.5–2.0%). However, this growth was by no means even, and it changed in character over time. Four phases can be identified from the mid-19th century onwards:

The Period of the Atlantic Economy, ca. 1850–1931

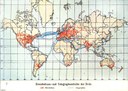

During this period, growth in the global economy was concentrated in Europe and in sparsely populated settler colonies in temperate climate zones on other continents (particularly the USA; but also Argentina, Canada, Australia, and to a lesser extent Russia). Trade was primarily based on the exchange of industrial goods for dietary staples and industrial raw materials.

Economic development in this period was strongly influenced by the acquisition of land reserves overseas for the production of unprocessed materials for export. This required the immigration into these territories of masses of settlers, and during this period leading up to the global financial crisis approximately 50 million people migrated from Europe to other continents[

Regions in Asia, the Americas and Africa which were not suitable for the settlement of European migrants profited to a far lesser degree from growth in the global economy. The income-weak economies which developed in these zones came to be referred to as the Third World in the third quarter of the 20th century.

Deglobalization, 1931–1944

After the First World War, the global economy stagnated, and then experienced a veritable collapse in the global economic crisis (1929–1932). Nominally, trade fell by 20%, but when deflation is taken into account – and it hit traded goods harder than non-traded goods – the decrease was considerably larger in real terms. International capital markets disintegrated due to the widespread insolvency of sovereign debtors. This decline in globalization was reflected in institutional terms in deviations from the international gold standard (beginning with Great Britain in 1931), in the introduction of high protective customs tariffs, and in the advent of government-controlled trade regulated by bilateral payment treaties (starting with Germany in 1934).

The Organized Global Economy, 1944–1973

This period was characterized by rates of growth in the national income of individual economies from about 1950 onward which are unparalleled in history. In this period, the degree of global economic integration of the developed countries – in contrast to the Third World – grew rapidly to reach approximately the same level as had existed directly before the First World War. However, this reconstruction of the global economy was based solely on trade in goods.

In order to maintain the freedom of the individual state to act and to control growth within its own economy, international economic ties were organized on the basis of highly-formalized regimes. The currency regime (1944–1973) which emerged from the conference held by the Allies in 1944 in Bretton Woods (New Hampshire, USA) on the restoration of international economic relations was undoubtedly the most important of these. In western Europe, this regime was supplemented by the beginnings of European integration, which at first primarily promoted connections in the economic sphere.

From Stagflation to the New Wave of Globalization, 1970s–1990s

The 1970s were characterized by the disintegration of the system of Bretton Woods, inflationary shocks and low economic growth in the developed economies. The monetary stabilization implemented in the leading economies (particularly the USA) in the early 1980s was accompanied by widespread recession and an interest shock which resulted in a wave of solvency problems on the part of sovereign debtors in the Third World, i. e. a debt crisis.

In tandem with the macro-economic stabilization, a range of structural reforms occurred in many countries from around 1980. Having isolated themselves from the global economy to a large degree in the third quarter of the 20th century, China and India – the most populous economies of the world – switched to a path of export-oriented growth and liberalized their foreign trade. Numerous other Asian and Latin American countries, particularly Brazil, followed suit. This reorientation was motivated by the fact that the growth potential of substituting imports with domestic industrialization had been exhausted. This form of industrialization had been aimed at supplying small, isolated national economies since raw materials prices had collapsed during the global economic crisis. In highly developed countries, many markets were deregulated, such as labour markets, markets for transportation services and, in particular, capital markets. These reforms occurred in the context of widespread acknowledgement that the efforts of individual states to control their own economies in the 1970s had proved largely ineffective.

Together with the revolution in information technology, which reduced the cost and dramatically increased the speed of communication over long distances, these structural reforms triggered a new wave of globalization. In particular, international capital markets experienced a renaissance, and direct industrial investment by multinational companies increased rapidly.10 Parallel to this, the structure of the trade in goods changed. While the period of the Atlantic economy had been characterized by the exchange of raw materials for industrial goods, the second wave of globalization at the end of the 20th century confirmed a trend which had been detectable since the 1950s: the dominance of intra-industry trade.

Explanations for the Wave of Globalization in the Mid-19th Century

Technological Progress

The classic explanation of the first wave of globalization points out technological innovations, particularly the building of steam-powered railways (the central tracks were laid in the third quarter of the 19th century), the transition to steam-powered ships with steel hulls on the high seas (from the 1850s), as well as the electrical telegraph (the long-distance lines were laid from the 1850s). These innovations made transportation and information transfer

Market integration in the 19th century has been analysed empirically by comparing grain prices in as many cities as possible. These studies have demonstrated that the European grain markets became noticeably interconnected from about 1820 and that the USA essentially only joined this already well-integrated international grain market

Institutional Explanations

Invariably, the liberalization of free trade and the emergence of the gold standard are also mentioned as contributing to the first wave of globalization around 1850. But both of these processes appear to have been of secondary importance.

Great Britain liberalized its foreign trade by repealing the Corn Laws (1846) and the Navigation Acts (1849). In 1860, the free trade movement on the continent led to the so-called Cobden-Chevalier Treaty between Great Britain and France, which was signed by Richard Cobden (1804–1865) and Michel Chevalier (1806–1879) on behalf of their respective governments. To avoid their exports being discriminated against, other European countries sought to conclude free trade treaties, initially primarily with France. By 1875, a network of more than 50 such treaties was in place, all similar in structure. The liberalization of transit traffic and the introduction of the most-favoured-nation clause – stipulating that trade advantages could not be granted to one single trade partner alone, but had to be granted to all – resulted in a kind of international system which survived the renewed raising of customs tariffs from the end of the 1870s. However, the direct effects on bilateral trade were selectively limited to a small number of industrial goods which were nonetheless of considerable importance to the respective treaty partners.13

The gold standard, which first developed in Great Britain in the 1820s and 1840s, stabilized trust in the capacity of banknotes to retain their value because it introduced rules regarding the convertibility of banknotes into gold by the central bank, as well as rules regarding the holding of gold reserves to partially cover the banknotes in circulation. Additionally, under the gold standard the central banks pursued targeted monetary policies including transactions on money markets and capital markets for the first time. Germany's transition to the gold standard (1871–1876) brought about a chain reaction. By the 1880s, an international gold standard with a system of fixed exchange rates had emerged. One can argue that the removal of the risk involved in fluctuating exchange rates promoted international trade and the flow of capital. Indeed, countries which accepted the gold standard could avail of international loans at lower interest rates than countries with other currency regimes. However, it has not been proven that the international gold standard had any effect on the international goods trade.14

Endogenous End of the First Wave of Globalization

By the early 20th century, the emigration of large numbers of Europeans to regions in temperate climate zones outside Europe had brought about an international convergence of real wages within the Atlantic economy. The shortage of workers in overseas regions became less acute, while emigration and economic growth eased demographic pressure in Europe. Falling transportation and communications costs had the effect that goods prices on either side of the Atlantic gradually converged, which over time negated the forces which had driven expansion in the Atlantic economy.

Additionally, price and wage convergence roused globalization's losers into action. They founded interest groups and campaigned within their national political systems for measures to retard globalization in order to reduce or eliminate the negative consequences which globalization implied for them. Outside Europe, this primarily involved workers demanding the introduction of immigration limits in order to protect their high wages. Their efforts yielded success to the extent that the USA and other destinations of European emigration introduced increasingly severe immigration regulations in the first third of the 20th century. Together with the declining difference in real wages, these measures meant that the flow of migrants across the Atlantic largely dried up by the 1930s.15

On the old continent, the over-supply of American grain reduced the ground rents of the large landowners and the surplus-generating farmers, resulting in a movement for the introduction of protective tariffs. Starting with Germany in 1879, many continental European countries introduced grain tariffs. These were raised considerably in the aftermath of the First World War, thereby hindering the international grain trade in the interwar period.16

These observations indicate that globalization is not a self-sustaining process. A wave of globalization can have the effect of gradually removing the imbalances which have given rise to the wave of globalization in the first place, and forces which have promoted global economic integration can thereby dissipate all by themselves. And if globalization also affects different social groups in different ways, individuals harmed by globalization can form interest groups and campaign for the erection of barriers to globalization. Deglobalization can therefore be the endogenous result of the preceding globalization.

The Role of Global Economic Factors in the Global Economic Crisis (1929–1932)

Prior to the crisis which has been developing since 2008, the global economic crisis of 1929 represented the biggest international crisis of the modern period, resulting in a period of deglobalization. Of the number of international aspects to the crisis, we shall discuss the following two:

Firstly, the extreme fall (75%) in the prices of agricultural raw materials (1925–1933) was preceded by latent supply-side pressure in the aftermath of the First World War. Emigration from Europe reached its climax in the final years before the war, and in the early 1920s the resulting increase in the production of staples overseas entered the international markets. Simultaneously, the demobilization of military personnel after the war resulted in a recovery in agricultural production in Europe, and this production was protected by protective tariffs which tended to be even higher than those which had been in existence prior to the war. From the mid-1920s, the governments of the USA and Canada tried to stabilize agricultural prices by buying agricultural produce and putting it into state storage. The attempts of, in particular, the USSR and Australia to maintain profits by boosting production caused this policy to fail in 1929 and contributed to serious deflation, which in the USA resulted in the bankruptcy of numerous regional banks which had been heavily involved in providing finance to agriculture. The German banking crisis

Secondly, faults in international currency policy and, in particular, the system of fixed exchange rates which resulted from the gold standard played a large role in the deterioration of the international economic crisis. Fixed exchange rates resulted in the almost unhindered transfer to other economies of a deflationary trend occurring in one particular country (in this case, the USA). The falling prices of domestic goods became more competitive on the global markets, therefore reducing imports and increasing exports. The fear of losing gold prompted the central banks of the trading partners in a system with fixed exchange rates to suppress domestic demand by raising interest rates, which increased deflationary pressures. Deflation ultimately has a negative effect on economic growth because it prompts consumers to defer purchasing and reduces returns of investments (at the end of a production process, the profits are less than has been anticipated at the start). Consequently, the most effective measure taken against the financial crisis after 1929 was coming off the gold standard and the introduction of an expansionary monetary policy. International comparisons show that the earlier individual countries dismissed the gold standard, the quicker they recovered. The lessons of the global economic crisis have had a profound effect on the monetary policies of central banks in the crisis which has been on-going since 2008. Indeed, Ben Bernanke (born 1953), who has been president of the US Federal Reserve since 2006, has contributed to research into the topics discussed here.18

Why Was the System of Bretton Woods so Short-lived?

As already mentioned, the period of Bretton Woods (1944/58–1973) was characterized by levels of economic growth which are unique in history. Though it is difficult to prove this in detail, it seems likely that the specific structure of the currency regime contributed to this extraordinary growth. This regime succeeded in reducing capital costs by combining low fluctuation in exchange rates, stable inflation rates, and stable, low real interest rates, thereby supporting the transition to more capital-intensive modes of production following the example of the USA which occurred in this period.

But why did this regime ultimately prove to be so short-lived? The currency regime of Bretton Woods essentially functioned as follows: the US Federal Reserve maintained the convertibility of the US dollar to gold at a stable price of 35 dollars per ounce, while the other central banks kept the exchange rates of their currencies against the US dollar stable by buying and selling US dollars. The primary reason for the failure of this system was the "Triffin paradox", which was named after the Belgian economist Robert Triffin (1911–1993).19 It states that, due to the strong growth in global trade during the 1950s and 1960s (see section 4.3), central banks required more reserves in order to counterbalance short-term changes in exchange rates which resulted from trade fluctuations. However, gold production grew considerably more slowly than global trade in this period, with the result that the US dollar was increasingly used as a reserve medium. Since the central bank reserves of the European countries were so depleted at the end of the Second World War, these countries had to run a current account surplus against the USA in order to rebuild their reserves. Thus, regular current account and capital account deficits (due to the increasing foreign direct investment of US companies) on the part of the USA were needed so that the central bank reserves of the other countries could grow in line with the growth in global trade. These deficits resulted from inflation and budget shortfalls which were caused by high military spending during the Vietnam War and increasing social welfare costs. However, in view of the dwindling gold reserves of the US Federal Reserve, the growth in receivables denominated in US dollars undermined international trust in the gold convertibility of the US dollar.

During the 1960s, this declining trust led to increasing volatility in international gold markets and to rising appreciation pressure on the currencies of surplus countries, particularly the German mark and the Japanese yen. Additionally, current account surpluses had the effect that high inflation in the USA was transferred to Japan and the Federal Republic of Germany. It was primarily this issue that finally prompted the German Federal Bank to relinquish its fixed exchange rate against the US dollar in 1971. By 1973, the gold convertibility of the US dollar had been dispensed with, and fixed exchange rates were relinquished in most developed countries.

The Emergence of the Third World

Regions in Asia, the Americas and Africa which were not suitable for the settlement of European emigrants were only partty affected by the dynamic growth of the Atlantic world. These were countries whose resources were less in demand, which had large autochthonous populations, and in which the extraction of exportable raw materials was less labour-intensive, as was the case with mining in particular.

From the early 19th to the early 20th century, the prices of exported raw materials did rise relative to imported manufactured goods in countries which Europeans did not migrate to in large numbers. However, since these countries mostly exported customary colonial goods (particularly sugar, coffee and tea), they experienced less growth stimulation as a result of globalization than regions which concentrated on new trade goods such as dietary staples and industrial raw materials. Additionally, the exports of these countries were prone to particularly strong price fluctuations, perhaps because the demand for these goods was more income-elastic. These strong fluctuations in the prices of exports relative to imports had a negative effect on economic growth.20

These circumstances were reflected by debt crises. While capital overwhelmingly flowed into European settlement colonies, the old peripheries of the global economy which primarily produced traditional raw materials were more frequently hit by solvency crises during periods of recession. These solvency crises resulted in serious volatility, which could result in the loss of independence. This occurred, for example, in Egypt, which was occupied by the British in 1884

Due to incomes that were low compared with Europe and the countries of European settlements and that grew less quickly, domestic demand was very slow to develop in the emerging Third World – which was not referred to as such until later. Consequently, there was no stimulus for the development of indigenous industry. This in turn had a long-term negative effect on demographic development. In countries where industrial development required more human capital than the production of agricultural produce using simple technology, industrial development provided an incentive to families to limit the number of offspring and to invest more time and money in the children's education. In countries which concentrated on the production of raw materials which required low levels of skill and knowledge, on the other hand, parents preferred to have larger numbers of offspring. As a result, there was strong population growth in countries with low levels of industrialization during the 20th century. This had the effect of negating income growth due to economic growth and perpetuated – or even increased – global differences in income.22 It was not until the wave of liberalization in the late 1970s and the micro-technological revolution which began in this period and which drastically accelerated and reduced the cost of the long-distance transfer of information between and within companies that a number of so-called emerging economies succeeded in using globalization effects to achieve levels of economic growth which allowed them to close the gap between themselves and the developed economies.