See also the article "Consommation et circulations transnationales" in the EHNE.

Preliminary Remarks

Trade makes nations and economies more productive and efficient as regards their factor allocation1 and the goods bundles available to them. Openness to the outside world often results in learning processes, for example by means of cultural transfer and the transfer of technologies.2 In particular, trade makes it possible to find a market for products which are surplus to domestic demand and it therefore promotes economic specialization. It also makes it possible to achieve increased profits over and above what can be achieved in an already saturated domestic market. This principle was a mantra of many mercantilist theorists. Trade also reflects one's own economic performance, like a "window on the world" so to speak. It enables interaction and connectivity, and – if all other prerequisites are satisfied – it presents the opportunity to read signals from the global market and to integrate this information into the domestic economy to obtain an economic advantage through further specialization or productivity increases. Through imports, trade also grants access to the natural resources and pre-processed raw materials (semi-finished goods or so-called inputs) required for domestic production but which the domestic market cannot supply. Directly or indirectly, trade can be the primary engine of economic momentum, at least temporarily. Conversely, under different conditions and parameters, trade can have negative consequences for one or more of the participants and can result in underdevelopment. These connections are described more closely below by means of an overview and selected examples.

Structures, Volumes and Trends

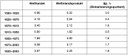

The time period dealt with in this article spans a number of the historical periods commonly used in periodizations in historical studies. The period from ca. 1450/1500 to 1800 is usually referred to as the early modern period.3 From the perspective of the academic discipline of economics, the pre-industrial age ended around 1800. The phase of early industrialization began at this point, and lasted until 1870. The period from about 1870 until the outbreak of the First World War is frequently referred to as the "second industrialization" or "high industrialization". The period between the World Wars (1918–1939) is often referred to as the "trans-war period", and the period of the 1950s and 1960s and leading up to the oil price shock of 1973 is known as the "third period of industrialization " or as the "golden age". The historiography of trade and cross-border connections also has its own periodization. Reference is commonly made to a period of "proto-globalization" or "early globalization" between 1500 and 1800 (beginning with the voyages of discovery of Christopher Columbus (1451–1506) in 1492 and of Vasco da Gama (1469–1524) around the Cape of Good Hope in 1499/1502); and the 19th century is frequently identified as the period of globalization proper. The period as a whole (1500-1900) witnessed the emergence of new trade routes and the development of new transport and communications technologies, which permanently transformed European and global trade flows, both in terms of their volumes and their structures.4 According to recent calculations5 by the British economist Angus Maddison (1926–2010), the gross domestic product (GDP) per capita, which gives a rough measure of the development of productivity and of the economic development of a society, increased fourfold in Europe between 1500 and 1946, from 797 to 3917 international dollars. If one compares 1500 with the year 1941, in which the armaments industry was running at full capacity in Germany and western Europe, then the increase was more than fivefold. However, long-term economic development proceeded in waves. Using this model of calculation, total economic output in northwestern Europe – the leading economic region of the period – only grew by a little over half during the so-called early modern period, by 55 percent to 1235 international dollars. By contrast, it grew by 69 percent to 2080 international dollars in the five decades of globalization (1820–1870), and grew continuously thereafter, increasing by a further 77 percent to 3687 by 1913. The First World War was followed by the interwar period. For a number of countries and population groups, this period was extremely difficult and featured various economic crises. For example, Germany experienced a depression after 1918 and hyperinflation in 1923. The trans-war period also witnessed the rise of protectionism, the Great Depression and subsequently the rearmament and military mobilization of the 1930s, as well as the dramatic collapse as a result of the consequences of the Second World War. The GDP per capita of northwestern Europe was only slightly higher in 1946 (the first year after the Second World War) than it had been in 1913 (the last year before the First World War), at 3917 compared to 3687 international dollars. This represents an increase of only 6 percent, or an average annual growth rate of between 0.1 and 0.2 percent for the whole of the trans-war period. As a result of the World Wars and the loss of global market share experienced by leading industrial nations, particularly Great Britain, as well as the economic and political crises of the period, the growth potential of the European societies declined rapidly during this period. There was a similarly rapid decline in the economic integration of the region. When measured in terms of foreign direct investment as a proportion of the total size of the European economy – a measure of capital flows across borders – the level of integration of the economies and societies of Europe in 1913 was not reached again until 1980.

The trends which economic and global historians often construct over longer time periods also indicate smaller intermediate cycles. For the purpose of conducting comparisons across larger geographical spaces and over longer time periods, and in the absence of dependable data on per capita income, other data relevant to economic and social development can be evaluated. In the past, economic historians have applied a so-called Malthusian model. Proceeding from assumptions regarding the interplay between population figures, available food resources (cereals) and limited technological parameters, it is possible to document – at least in an approximate way – how real incomes6 developed for certain homogenized groups of workers (e.g. stonemasons and day labourers) in the larger cities using records of cereal prices and wages. What emerges is a similar development in most regions of Europe, but with some regional differences. The 16th century is viewed as a period of population growth which witnessed considerable reductions in real wages. In the Netherlands real wages in the construction sector fell by about 6 percent, in England (London) they fell by about 15 percent, and in southern Germany and the hereditary Habsburg territories (Munich, Augsburg, Vienna) they fell by a full 34 percent. In the 17th century, population growth was very low in most parts of Europe, with the exception of the Netherlands and the southeast of England, particularly London. In the Netherlands, real wages increased between 1600 and 1700 back up to the level they had been at in 1500. During this period, the Netherlands was the most progressive and wealthiest country on Earth and experienced its "golden age", a process of economic and social structural transformation which was unparalleled in that era, and which saw Dutch per capita income rising between 1500 and 1750 to almost twice the average for northwestern Europe as a whole. In the rest of continental Europe, the fall in real wages of the 16th century was only partially reversed during the 17th century. Economic potential did not rise ("crisis of the 17th century").7 During the 18th century, some regions of Europe experienced more dire losses, while the Atlantic economies, Britain and the Netherlands, were roughly able to maintain their levels of prosperity

The 19th century witnessed great changes which for the first time in history called into question the Malthusian trap and the link between population, food supply and income.8 Between 1800 and 1950, the population of Europe grew by about 123 percent from 115 to 257 million people, while the overall economic output – the GDP of northwestern Europe – grew by 813 percent, and the per capita income increased by 305 percent. Thus, the average level of available economic resources grew twice as quickly as the population.

Much less is known about Europe's external trade. This is not least due to the scarcity of sources, to territorial fragmentation – particularly in central Europe – up to the late-19th century, to the extremely fragmented recording of commodity flows, and to the difficulty involved in using non-comparable figures, the dependability of which is unknown, for hundreds of regions and countries for different periods. It is often necessary to make use of proxy data. For example, it is assumed that the number of ships returning from Asia laden with spices increased annually by averages of 1.01 percent in the period 1500–1600, 1.24 percent in the century 1600–1700 and 1.16 percent in the period 1700–1800.9 During the early modern period, an average annual growth rate in European overseas trade of about 1.2 percent when compared with an estimated average growth rate in per capita GDP of 0.24 percent in Europe seems not only respectable, but gigantic. Thus, the growth in European and global trade during this period was about five times as strong as economic growth. No other period in history witnessed a comparable trend. Even during the almost two centuries between 1820 and the present day, the long-term degree of integration of the global economy was only about 1.2; in the early modern period it was more than three and a half times higher (3.0)

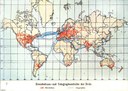

And also for Europe, particularly northwestern Europe which was the first industrializing region of the world, the volume of trade rose eightfold (793 percent) between 1820 and 1870, while economic output grew by a quarter (26 percent) in the period 1850–1870.10 Again, external trade volumes grew much more quickly than Europe's own economic output, a fact which emphasizes the importance of foreign and intercontinental trade for the European economy, but also for the economic integration of Europe. It is important to note that the overall economic and commercial development of Europe had already become increasingly interconnected from the late-medieval period. This period experienced not only an increasing exchange of goods within Europe, but also increasing interaction with the rest of the world.11 In addition to economic integration, transcultural connections undoubtedly already increased during the early modern period. Travelogues, chronicles, ships logs, customs records and trade statistics from the largest cities of northwestern Europe attest to the existence of this trend from the late-17th century in particular. After 1800, the connections between a dynamic and increasingly industrialized European economy and the rest of the world resulted in an unequal division of labour, in the emergence of commodity chains and in the economic marginalization of poorer regions of the world. The latter increasingly functioned as suppliers of raw materials for the industrialized world. Some academics refer to this process as development towards underdevelopment.12 In any case, it is clear that the disparity between the individual regions of the world, particularly with regard to growth potential, increased further after 1800. After 1820, the economic performance of large parts of Asia, Latin America and Africa fell further behind that of Europe than ever before.13

The structure of trade volumes also changed fundamentally. Europe was a territorially comparatively fragmented macro region with a long and in places very rugged Atlantic, North Sea, Baltic and Mediterranean coastline. Very poor roads and the absence of institutional, infrastructural and economic coordination at the inter-state and supranational level made sea-borne trade a more attractive alternative to the transportation of bulk goods over long distances over land for a long time before 1900.14 While in the preindustrial period it was primarily staples transported in bulk with low unit costs15 which were traded overseas, during the period of industrialization and globalization of the 19th century manufactured goods and industrial raw materials formed an increasingly significant part of European foreign and intercontinental trade. Thus, the structure of the trade volumes of individual countries and regions also reflects their varying degrees of economic development. If one considers the distribution of trade volumes between the sea and the land, and the contribution made by foreign trade to overall economic output, it becomes even more difficult to draw dependable conclusions. It is estimated that in the 18th century, 98 percent of Russia's trade occurred over land, with sea-borne trade accounting for just 2 percent. This value is based on the fact that foreign trade is estimated to have constituted 2 percent of Russia's social product at that time.16 In the case of wealthier and more developed, open economies such as Britain and the Netherlands, foreign trade already constituted a far higher proportion of total economic output in the early modern period. In the mid-18th century, exports may have accounted for as much as 12 to 13 percent of British GDP.17 The same applies to the Netherlands.

Before discussing in more detail the history of the interconnections between trade and general economic activity, and between different nations and cultures using selected case studies, it is first necessary to discuss where this topic fits into broader theoretical and conceptual debates. Humans engage in trade in order through economic specialization to benefit from effects on wealth and income which would not occur in a world without trade. According to David Ricardo's theory of comparative advantage, a famous hypothesis from the 19th century, an economy should focus on the production of those goods for which they have to expend less resources18 compared to other traded goods19 compared to their respective trading partner. Consequently, more is produced than is needed to meet domestic demand. Surpluses are exported and in exchange those goods are bought which are needed to meet demand, but which cannot be produced domestically as cheaply as they are by the trading partner. This modern theory of foreign trade, which was primarily developed to describe the industrialized economies of northwestern Europe and the North Atlantic world, assumes that both parties profit from the division of labour, since both consume more goods and services in total than before (i.e., than in a hypothetical world without the division of labour). Viewed historically, and particularly in relation to the periods before industrialization, one must make some important qualifications and revisions. For a long time, the fact was ignored that a model which was originally designed for England and Portugal and which was based on the two traded goods of "wine" (Portugal's specialization) and "cloth" (England's specialization) could lead to a state of underdevelopment. This means that the party who specializes in primary production, in this case Portugal, loses out on economic growth and growth potential over the longer term compared with the producer of finished goods, in this case England. Trade does not necessarily always bring increased prosperity for all participants, in spite of the theories which were repeated in modern economics textbooks up to very recently; this becomes apparent when a non-static perspective is adopted and when the factor "time" – and thus a historical perspective – is included in the analysis.

A similar specialization model developed by the Swedish economic historians and economists Eli Heckscher (1879–1952) and Bertil Ohlin (1899–1972) predicts that economies will specialize in accordance with their specific factor endowment. Countries or economies in which the factor labour is plentiful compared to the factor capital (this includes the production factor of land) benefit from wages which are low by international standards and attract production processes which are more labour intensive than capital intensive (such as in industry and high industry), and vice versa. In contrast to Ricardo's model, however, this model is based on the assumption of a similar production function – both countries are equally productive in both sectors. But specialization is worthwhile, according to this theoretical assumption – which has historically often proved to be remote from reality – just as it was in the 18th and 19th century for Portugal to specialize in a process that required comparatively more labour input than capital input (wine production), and for England to specialize in a process which was predominantly based on the investment of fixed capital, for example, machines, fuel, steel and machine produced yarns and cloth. In 18th-century England, average wages were already so high by international standards and coal was so abundantly available, that it was already worthwhile concentrating on a capital-intensive, industrial mode of production. Some academics believe that this provided the economic incentive for the investigation and development of mechanized modes of production in the textile industry and in heavy industry, thereby laying the foundations for the first industrial revolution.20 However, this model ignores the difference between the income elasticity of raw materials compared to that of finished goods. For the producer of raw materials, these differences can lead to less dynamic development or even underdevelopment. This is an impressive example of how a historical perspective on economic processes using empirical historical data can enrich theoretical debate with additional insights. This enables us to adapt, review and improve the model. Thus, it is currently completely unclear whether free trade or generally liberalized foreign trade without onerous customs protections is profitable for all participants or results in economic development which is beneficial for all participants, as the mainstream theories of the 20th century often suggest.

The following sections will demonstrate the role that trade plays for the participants, and will emphasize – with regard to social and economic developments – the opportunities and risks which increased economic integration with the outside world can bring.

Histories of Trade and Integration

Silver – Europe and Asia in the Era of Early-Globalization

The return of the first trading fleet under Vasco da Gama represented the crowning conclusion of a long process of investigation and investment by the Portuguese. From the beginning of the 15th century, they had tried to sail around the southern tip of Africa in order to reach the Indian Ocean, the China Sea and the Maluku Islands (Spice Islands).

As already discussed, intercontinental trade along the spice route had grown considerably both in frequency and volume during the 16th century. The longstanding monopoly of Venice as an intermediary in the spice trade was broken. From the medieval period, these goods had been brought through India, Hormuz, Mocha and through the Red Sea via Alexandria to Venice

Just by shipping silver from Europe to Asia, a merchant could pocket the arbitrage profit22 which resulted from the price differences between the continents. However, in this way silver – and with it money – was removed from the empire. This strained situation manifested itself in deflation at a time of population growth, when one would intuitively have expected prices to rise. In accordance with the quantity theory of money, increasing economic activity can coincide with falling prices if the available money supply does not increase in line with the number of market participants. This was precisely the case in the first third of the 16th century. In the era of the Reformation, this deflationary depression brought with it a series of unbalanced processes of structural change and adaptation. This also involved a pronounced devaluation and debasement of coinage and frequent unrest in the urban and – even more so – in the rural context. There were also discourses on the decreasing quantity of precious metal in coins, on usury, "bad" money and the high profits which the merchants were making from the exportation of silver.23

Over the longer term, however, the money supply circulating in Europe grew from the mid-16th century. This was a result of the increasing importation of silver into Europe from the mines in Central and South America, particularly those in Potosí, in spite of the continuous flow of silver to the Baltic, to Italy and the Levant, as well as to Asia. A scarcity of available economic resources per capita of population had become increasingly noticeable from the end of the 15th century, particularly in the case of essential staple goods such as cereals and meat, as reflected in the prices. From the first third of the 16th century and up to around 1620, the prices of dietary staples rose faster than wages and the price of manufactured products throughout Europe. A so-called price revolution occurred – inflation which, with an increasing rate of growth of about 1.2 percent per annum, was modest compared to later periods, but which was clearly felt by the population of the time.24

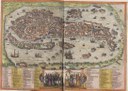

First Modern Economy? The "Golden Age" of the Netherlands (ca. 1500–1750)

Between 1500 and 1800, the Netherlands developed into the most affluent economy in Europe. While the average available income of a Dutchman25 around 1500 roughly corresponded to the European average, by 1700 the per capita income had doubled, though the average per capita GDP both in northwestern Europe generally and in the Netherlands also increased over the same period.26 The Netherlands adopted the following strategy: relative liberalization of the factor markets of labour, land and capital, as well as high levels of agricultural productivity which supported a high proportion of non-agrarians and an economy heavily based on the division of labour. Additionally, the state authorities protected property rights, guaranteed freedom of movement and profession, had a positive attitude towards the accumulation of wealth and economic growth, and consequently created the conditions for a free market economy. Additionally, the Dutch had technological and labour organizational expertise which promoted sustainable economic growth. The broad array of goods and consumables, which stimulated consumption and production, was also an important factor.

However, foreign trade was particularly important. The rapid pace of specialization from 1500 onward contributed in large measure to growth and economic development. In particular, advantages emerged in the key sectors of high-seas fishing, ship building, maritime transportation, and thus overseas trade and transportation services, as well as in the banking and financial sector in the global financial centre of Amsterdam. These sectors were all connected with each other in a dynamic way and exercised positive influence on the other sectors of the economy. By 1700, the Netherlands possessed the largest trading fleet in Europe and conducted the highest volume of trade on a per capita basis.27 As regards their productivity, they were particularly superior in the area of transportation, and they were able to offer competitive rates for freight, thereby becoming the transporters of the world.28 Interest rates in the Netherlands were very low by international comparison. Capital markets were deeper and public trust in state institutions as creditors and as a safe haven for the investment of surplus capital was stronger in the Netherlands than elsewhere. This advantage was reflected by the fact that the Netherlands had already had a high degree of urbanization from the late medieval period. If we take the percentage of the population living in cities with a population of more than 10000 as a measure of the degree of urbanization, by 1600 almost 25 percent of the population of the Netherlands lived in such cities, while the Holy Roman Empire of the German Nation with less than 4 percent living in cities of more than 10000 belonged to the semi-periphery.

Comparative studies on the levels of real wages29 internationally have also shown that a pronounced divide already existed by 1500. Workers in London received wages 25 percent higher than their counterparts in eastern central Europe. These differences increased during the course of the early modern period. In the 18th century, the average Dutchman and Londoner was nearly twice as well paid as his counterpart in Krakow. The former had not suffered the fall in real wages of the early modern period, which was increasingly characteristic of social and economic conditions and their development over time in continental Europe the further eastward one travelled. This divergence is one of the most conspicuous features of continental European economic history and a manifestation of diverse and interconnected processes.30 In the Netherlands, growth was based on the development of an impressive merchant fleet and the transportation – initially – of comparatively cheap bulk goods, such as cereals and salt. In the northwestern exchange between the Baltic and the North Sea and Atlantic, trade in these goods had increased in frequency, regularity, and volume from the late-15th century. The importation of cereals from the Baltic in exchange for the delivery of fish and Spanish bay-salt to the Baltic region followed the principles of the international division of labour and economic specialization, similar to the principles of modern international economic theory. The focus lay on comparatively capital-intensive production processes, particularly in the area of refinement, and on the transfer of economic activities which were not very capital-intensive and thus had less demand elasticity, such as cereal production, to the poorer peripheral regions of Europe, particularly to the eastern regions of the Holy Roman Empire of the German Nation and Poland. In high seas fishing also the Dutch employed production processes which were capital intensive and highly differentiated in terms of the division of labour, for example by sending a hundreds-strong trawler fleet to the north of the British Isles in the early summer each year to catch herring. By means of meticulous synchronized work and production processes, this fleet was able to catch, process and sell a gigantic quantity of fish by contemporary standards. Also in the spice trade, the Dutch led the way with the development of the first modern public limited company, the Verenigden Oostindischen Compagnie

Connections and interaction with the outside world, with other markets and regions in Europe and increasingly with the world outside Europe (particularly Asia) were a central component of this process of economic growth and structural change. These processes demonstrate that transcultural connections are not just helpful, but a completely indispensable prerequisite for growth and employment. The Dutch economic miracle was a source of great annoyance to other states and actors of the time, but it also prompted them to introduce in their own territories the incentives and recipes for success which had had such a transformative effect on the Netherlands.32

The growth of British foreign and overseas trade from the last third of the 17th century is a conspicuous example. A large quantity of Dutch expertise, but also cultural and economic capital moved from Amsterdam to London from about 1660 onward. The English also reacted to the commercial dominance of the Netherlands with three trade wars (1652–1654, 1655–1667 and 1672–1674) and with the introduction of high tariff barriers, as well as other protectionist measures. The system of customs laws which was introduced during the restoration of Charles II was intended among other things to exclude the Dutch from international transportation and insurance. They succeeded in doing this primarily by using the American and Caribbean possessions more intensively and by restricting the direct trade in colonial goods to English (and after 1707 British) merchants – measures which proved successful in the long term.33

The Individual and Change in the Structure of Consumption as an Economic Motor: The "Industrious Revolution" (1650–1800)

For longer periods of time, traditional historical studies denied that the individual has a basis freedom of action and therefore the possibility to influence economic and social development. Economic and social historians also often preferred to construct long time series of anonymized mass aggregates, in which the person does not appear as an individual but as just one of many data points. Macroeconomic data, such as prices, wages and real incomes have up to very recently led to the conclusion that the majority of people in the pre-industrial age were either impoverished or living just above the level of subsistence, and that there was therefore no leeway for economic development and growth in Europe in the pre-industrial era.34 Recent research, particularly that of Jan de Vries,35 has fundamentally revised these evaluations. As the previous example of the Dutch "golden age" has already demonstrated, possibilities for dynamic development and action in the process of production and consumption also existed in the pre-modern era. The unparalleled rise in colonial trade in the period 1650–1800, particularly the importation of sugar,36 tobacco,37 coffee, tea and chocolate, demonstrates that Europeans did have money to spend on consumption above and beyond the basic three requirements for survival (nutrition, clothing and heating).38 Large quantities of these products were re-exported,39 primarily to the continental European market. There is proof that tobacco smoking was already common among mercenaries in all of the participating armies during the Thirty Years War. Dutch painters of the time employed it as an almost ubiquitous motif, particularly when painting the lower classes of the population. From the mid-17th century, luxury goods from outside Europe were part of the consumption and the preferences of the lower-income classes also.40

How can we explain this development? On the supply side, productivity in maritime transportation rose and transaction costs fell, not least due to the commercial competition in this area between the Netherlands and Britain in the mercantilist age (1600–1800/1850). The Dutch in particular succeeded in reducing the ratio of ship tonnage to crew size to a competitive level. This measure enabled them to offer transportation services to the rest of Europe. The stimulation of the colonial economy through the Navigation Acts 1651/1660, the customs system of the Restoration period (1660) and a restrictive trade and customs policy played their part in directing the flows of colonial goods so that from 1660 onward the greater part of all consumables imported from the Caribbean and North America entered Europe through England and (from 1707) Scotland. The goods had to be brought ashore there first before they were distributed to the European markets. These monopoly profits had the effect of greatly stimulating the commercial endeavours of British entrepreneurs.41 The merchants could offer the goods at low unit costs and in large quantities to the French, Dutch, German and Scandinavian markets. But in order for it to be possible to sell such quantities in these markets in the first place, a structural change on the part of consumers was necessary. From the 16th century onward, people in many parts of northwestern Europe were engaged by questions of production and consumption. In England and the Netherlands, the number of public holidays fell as a result of the Reformation, and the average number of hours worked per annum rose from 3100 in the 16th century to 3700 after 1650. In the case of England, it has been shown that a rise from 2700 to 3300 occurred in the period from 1750 to 1830. Thus the workload of a Londoner increased by fully 40 percent.42 More and more people engaged in side-line activities, particularly in home crafts, to increase their low incomes. They increased their consumption, replaced their clothes more often, and drank Chinese tea sweetened with Caribbean cane sugar. People enjoyed the mildly stimulating effect of nicotine in tobacco, as it suppressed the ubiquitous hunger pangs. Subsequently, the trade in colonial goods and the East India trade continued to grow. The individual was increasingly integrated into commercial contexts. According to the hypothesis of the "industrious revolution", people became more industrious because they received the appropriate market and consumer-preference incentives. This laid important foundations for subsequent industrial growth after 1800, at least in northwestern Europe, where the "industrious revolution"43 became apparent in an ever increasing number of places and areas.

Large Divergences, Textile Production and the Role of the State: The Demise of India and the Rise of England to an Industrial Nation

The industrialization of England's cotton textile production in the 18th century is a classic example of how previously positive conditions can have negative effects – for the respective trade partner. In this case also, interaction with Asian markets and the reception of signals and stimuli from the consumer by merchants and producers played a central role. From the end of the 17th century, Indian cotton fabrics – known as calicos and muslins – imported by the London East India Company enjoyed increasing popularity among the better-off classes in England. Simultaneously, there were increasing calls that the domestic market should be protected against these imports and that the market for domestically produced cloth should be stimulated. In 1685, the import duty on India cotton fabric was raised from 7.5 to 17.5 percent. In 1690, the duty was raised again up to nearly 30 percent of the value of the imports. In 1700, the domestic lobby scored a decisive victory as the importation of literally all processed India cotton fabric was prohibited. It was now only permitted to import processed fabric in order to sell it into foreign markets or to import unbleached and undyed calicos and muslins for the domestic English market. In this way, the English producers were able to secure for themselves a first important step in the goods chain, the refinement process. There is evidence that the English were successfully exporting high-value refined cotton handkerchiefs by 1711. In 1721, the second step in this important process of substitution occurred with a general import ban on Indian inputs, which included unbleached and unprinted cotton fabric of all kinds, with just very few exceptions. The lobbyists of the silk and woollen industries, as well as the growing cotton industry in the northwest of England (Manchester), repeatedly got their way.

The stimuli to change the structures and production functions in the cotton fabric sector initially came from another production sector, from linen weaving. Linen fabric was cheap to produce and to buy, and it was most commonly worn by Europeans and Americans during the summer season. With the emergence of the production of colonial goods and the connected slave trade or triangular trade from the 16th century, linen was increasingly exported to the warmer overseas possessions of Portugal, Spain, England and even the Netherlands. There linen was used as clothing for slaves. The Europeans used the fabric to obtain increased production and profit margins through export. Whole regions of Europe specialized in the production of linen cloth, for example Silesia in the Holy Roman Empire of the German Nation, and large parts of Scotland and Ireland. In these regions, linen was primarily produced in a decentralized fashion as a home and side-line activity in the agricultural sector. The control over production and distribution was often in the hands of large merchants operating at the supra-regional level, who incorporated these regions and their produce into the larger logistical network of the Atlantic economies.

In northwest England but also southwest Scotland around Glasgow, merchants and fabric producers began to successfully produce a cotton-linen composite fabric around 1730, which could be printed and dyed in the usual Indian fashion. These composite fabrics were cheaper than the pure Indian cotton fabrics. This made it possible to incorporate the lower-income classes of society into the consumption process, thereby greatly increasing the market for this new industry, which grew rapidly from about 1730. However, these substitute products made from linen mixed with cotton were only a temporary solution. Only the genuine cotton fabric sector could secure lasting success, and in this area there was still considerable deficits in knowledge and skills compared with the Indian producers. These learning processes progressed continuously under the leadership and protection of the state. In 1787, the import duty on muslin was increased to 100 percent, and many merchants made a credible case that the British producers had reached the standard of quality of the Indians. At the same time, the first steps were made in the construction and use of mechanical spinning frames. Around 1780, English cotton fabric producers manufactured a cloth which could hold its own with Indian products in terms of quality. By mechanizing important stages of production – initially spinning and in the late-18th century weaving also – for example in the form of steam-powered looms, the cloth became much cheaper to produce. Thus one of the pillars of Indian fabric export to the global market slowly but surely collapsed. After 1830, India hardly exported any cotton fabric, while England or Great Britain at the same time underwent the first industrial transformation in history

Structural Change and Underdevelopment: The Importance of Regionality and Industrialization – the Example of the Southern States of the USA (1800–1950)

In the 19th century, the conditions for manufacturing, agrarian production and commercial exchange were fundamentally transformed. The trading links among Europeans and between Europeans and the outside world increased in a previously unprecedented fashion. As the industrialization of the European economies proceeded apace, and incomes and the number of people in industrial employment grew, the range of industrially produced goods and the raw materials needed to produce them also grew. New transportation routes (such as the Suez Canal), and new modes of transportation46 and communication47 resulted in a more intensive economic integration of the world.48 However, the increasing connections

The USA is considered the main beneficiary of the second phase of the industrialization process. By 1900, the USA had overcome its initial deficiencies to catch up with England at almost all levels, and as regards economic output, per capita income and exports it had become the global leader, a position which it retained into the 20th century. However, there were considerable regional differences in economic performance and growth potential. This had less to do with the economic geography or material-physical conditions of the respective regions than with a rigid institutional framework which restricted the free economic and general personal development of the majority of the population. While entrepreneurs in the north and northwest of the USA became the leading producers of industrial goods in the world from the mid-19th century onward, the American South temporarily became a leading region for the exportation of raw cotton. In the short term, the boom – which grew particularly strongly around mid-century due to the growing global demand for cotton – brought enormous profits to the plantation owners in the South.49

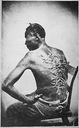

Slavery had been introduced both as a system of production and a social order on the Caribbean islands in the 16th century . During the 17th century, it had been "perfected" and "exported" to regions of the American mainland. Due to the physical geography of these regions, it was possible to specialize in the production of raw materials and inputs in monoculture.50 Slavery

. During the 17th century, it had been "perfected" and "exported" to regions of the American mainland. Due to the physical geography of these regions, it was possible to specialize in the production of raw materials and inputs in monoculture.50 Slavery

While the increasingly industrialized regions in the northeast and north of the USA became some of the leading economic regions of the world, the southern states fell far behind the northwest and the midwest as regards average incomes, life expectancy, crime rates, literacy levels, and employment levels. Up to the mid-20th century, the southern states remained at the level of many present-day African and developing countries in terms of these indicators. The history of trade teaches us an important lesson here: over the long term the exportation of raw materials has considerably less multiplier effects that the exportation of manufactures. If one specializes in the production and exportation of raw materials, you lose growth potential over the long run, particularly compared to the exporters of manufactured goods, even though spectacular growth levels and booms may occur in the short term, as occurred in the southern states of the USA during the 1850s. The lower growth results from the fact that the income elasticity of the demand for raw materials is less than that of the demand for manufactures. If an economy or a region is integrated into a more concentrated division of labour and logistical network with the outside world, and if that economy or region has concentrated on a particular raw material which is not processed within the region itself, or if the region retains social, legal or institutional structures which hinder growth and economic development, the risk of failure increases with the increasing degree of integration. The above example demonstrates that this even applies to comparatively wealthy countries and economies.

Conclusion

Europe constitutes an important and dynamic region of the world, at least in retrospect. The first recorded industrialization process in history occurred in northwestern Europe. This process dramatically transformed the income structure, patterns of consumption, and growth potential of the European societies. On the one hand, many indicators suggest that the roots or sources of this dynamic are to be found much further back than 1800. On the other hand, it is also clear that this development would scarcely have been possible in the scale in which it occurred without the increasing interconnectedness of the global economy and the increasing interaction with actors, regions and cultural circles outside Europe, which had already begun in the late-medieval period. The "European miracle" was not based on characteristics unique to the European economy or society, but primarily on transfer links with the rest of the world, albeit under asymmetrical conditions, that is, a division of labour which was disadvantageous for many non-European regions. All of the fundamental metanarratives and large fields of action of global history are reflected in the phenomenon of trade.